Corporate Governance

Basic Approach

FANUC has always worked on enhancing corporate governance based on our Basic Principles of "Genmitsu (Strict Preciseness)" and "Tomei (Transparency)." In 2021, as we proceed in separating our supervisory function and executive functions, in order to further strengthen the supervisory functions of the Board of Directors and speed up management decisions, we transitioned to a Company with an Audit and Supervisory Committee, which allows us to establish Audit and Supervisory Committee consisting of Directors who are Audit and Supervisory Committee Members and to expand the delegation of decision-making authority for business execution from the Board of Directors to Directors. Since then, as a Company with an Audit and Supervisory Committee, we have been working to further strengthen the supervisory function of the Board of Directors and speed up management decision-making, including by further developing related regulations.

In addition, FANUC has established the Nomination and Remuneration Committee, a majority of which comprises Independent Outside Directors, and is chaired by an Independent Outside Director. By increasing the objectivity and transparency of the appointment and evaluation of Directors, this committee ensures the strict preciseness and transparency of supervisory functions to management.

Promotion Framework and Initiatives

- As a company with an Audit and Supervisory Committee, we have separated the Board of Directors (supervisory function) from the management side (executive function) to maintain the independence of each.

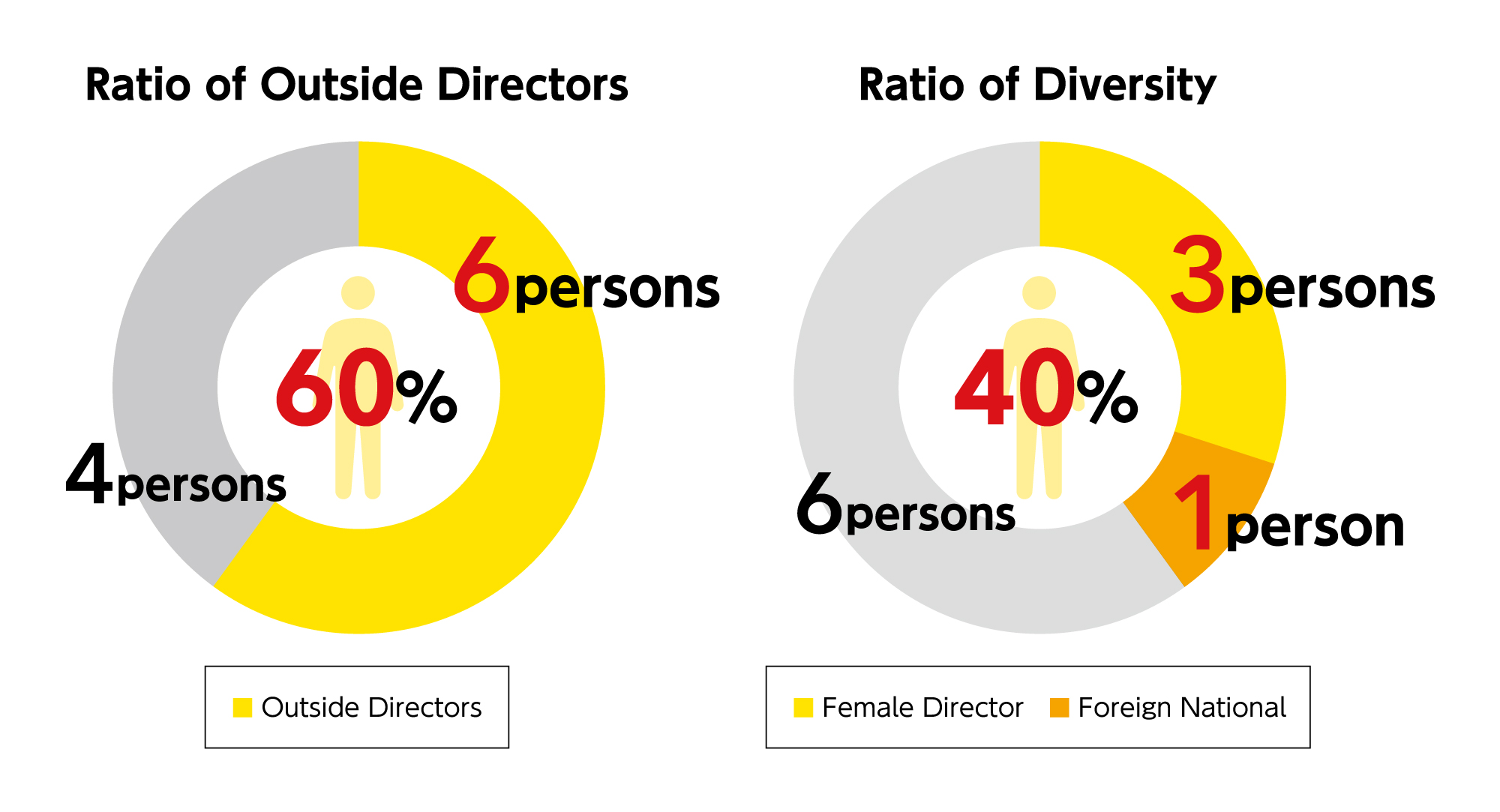

- The ratio of Outside Directors and the diversity ratio of the Board of Directors are as follows.

- Three of the four Audit and Supervisory Committee Members are Outside Audit and Supervisory Committee Members, one of whom is a woman.

- We continue to periodically review the contents of the Board of Directors and the Audit & Supervisory Committee from the perspectives of whether the independence of the Board of Directors and management is maintained, whether the effects of diversity are evident, and whether discussions in the Board of Directors and the Audit & Supervisory Committee are active, and make improvements as necessary.

Nomination and Remuneration Committee

With respect to appointment and dismissal and remuneration, etc. of Directors, we have established the Nomination and Remuneration Committee, the majority of which is composed of Independent Outside Directors, and chaired by an Independent Outside Director, to secure the objectivity and transparency, etc. of procedures through consultations by this Committee.

Analysis and Evaluation of Board of Directors Effectiveness

1. Evaluation Policy

In order to provide indispensable values throughout the world and to continue to be a company that is trusted by all stakeholders, we place great importance on corporate governance and thoroughly adhere to our basic principles, “Genmitsu (Strict Preciseness) and Tomei(Transparency),” making every effort to further strengthen supervisory functions, expedite decisions on business execution and improve management efficiency. As part of this effort, we evaluate the effectiveness of the Board of Directors every year.

2. Evaluation Process

The evaluation for the fiscal year 2024 was conducted based on insights given by external consultants for the purpose of understanding issues recognized by each director related to issues to be addressed, for example, matters deemed key to the effective fulfillment of roles and responsibilities of the Board of Directors (such as the structure and management of the Board of Directors and discussions on strategies), and also for the purpose of objectively confirming whether the Board of Directors is effectively fulfilling its role as expected by our shareholders and other stakeholders. We also confirmed the status of its efforts to address the issues recognized in the evaluation of the effectiveness of the Board of Directors of the previous fiscal year. In the evaluation, external consultants conducted a questionnaire survey of all directors, and then based on the results of analysis compiled by those consultants, our Board of Directors conducted reporting and discussions.

3. Summary of Evaluation Results

Considering the results of analysis compiled by external consultants, our Board of Directors analyzed and evaluated the effectiveness of the Board of Directors as follows:

- Considering the current business environment facing the Company, as it is particularly expected of our Board of Directors to “supervise execution” and “candidly express opinions and proposal and multi-dimensional discussions about, for example, issues that are key to execution and issues that are deemed important by stakeholders,” the Board of Directors was confirmed as functioning effectively with high ratings given to the fact that it is composed of a diverse group of members who are ideal for fulfilling such functions and active discussions are held, and so on.

- In the evaluation of the effectiveness of the Board of Directors of the previous fiscal year, we recognized the following two points as issues:

- Supervision of the performance of duties by the execution side and presentation of opinions to strengthen the organizational structure to respond to significant changes in the external environment

- Supervision of the performance of duties by the execution side and presentation of opinions to create a corporate culture and atmosphere that respect the spirit of challenge for sustainable growth of the Company.

- Further, through the current fiscal year’s evaluation, we have recognized (i) the need to provide opportunities to deliberate further on the plan regarding successors, such as the CEO, and (ii) the need to deepen discussions with the execution side on long-term management strategies and return on capital.

Our Board of Directors will constructively address the matters stated in (2) and (3) above and aim to contribute to sustainable growth of the Company.

Directors' Remuneration

(1) Matters concerning the Policy for Determining the Details of Remunerations for Individual Directors

FANUC has established a policy for determining the details of remunerations for individual Directors (excluding the Directors who are Audit and Supervisory Committee Members; the same applies hereinafter in this paragraph) (hereinafter, “Policy”) in place as outlined below. (Resolved at a meeting of the Company's Board of Directors held on June 27, 2025)

- Fixed remunerations shall be determined according to the position of each Director.

- Performance-based remunerations shall be, in principle, linked to the current net income attributable to the shareholders of the parent company, as is the case with shareholder returns, and 80% of the amount of - 19 - performance-based remunerations shall be determined by taking into account factors such as profit margin and ROE. The remaining 20%, as non-financial indicators, shall be paid according to evaluation standards. “Employee Engagement”, “External ESG Evaluation Score” and “GHG Emission Reduction” are applied as such evaluation standards.

- Stock-based remuneration shall be provided as remuneration of restricted stock, taking various factors, such as the degree of contribution of the Director, into consideration in a comprehensive manner.

- Remuneration for Directors comprises fixed remuneration, performance-based remuneration and stock-based remuneration whose ratios shall be set considering his/her position, responsibility, performance, etc., in a comprehensive manner.

- Remuneration of Outside Directors shall comprise fixed remuneration only.

The Policy shall be determined by a resolution of the Board of Directors.

As for remunerations for the Directors who are Audit and Supervisory Committee Members, the amount of remuneration for the individual Directors who are Audit and Supervisory Committee Members shall be determined by consultation among the Directors who are Audit and Supervisory Committee Members.

(2) Matters concerning Resolution of Shareholders’ Meeting on Remunerations for the Directors

With respect to the aggregate amount of remunerations for the Directors (excluding the Directors who are the Audit and Supervisory Committee Members), it was approved at the 52nd Ordinary General Meeting of Shareholders held on June 24, 2021 that it shall be capped at the sum of (a) the fixed remuneration limit and (b) the performance-based remuneration limit specified below. Further, it was also approved that, in addition to (a) and (b), (c)stock-based remuneration may be provided to the Directors except for the Outside Directors.

- (a) Fixed remunerations of 800 million yen or less annually (including 100 million yen or less annually for the Outside Directors);

- (b) Performance-based remunerations of an amount equivalent to 0.7% or less of the current net income attributable to the shareholders of the parent company for the fiscal year immediately preceding the Meeting of Shareholders at which they are appointed or reappointed (but not exceeding an amount equivalent to three years of fixed remunerations);

- (c) Stock compensation

The annual ceiling amount for the total amount of monetary compensation claims paid as remuneration for restricted stock is ¥350 million. The upper limit of the total number of shares of restricted stock to be allotted in each fiscal year is no more than 28,000 However, on or after the date of approval by the 52nd Ordinary General Meeting of Shareholders held on June 24, 2021, this total number of shares of Restricted Stock may be adjusted within reasonable limits if a stock split (including an allotment of the Company’s common stock without consideration) or a reverse stock split of the Company’s common stock takes place, or if other similar circumstances arise in which adjustments become necessary to the total number of shares of the Company’s Restricted Stock to be allotted.

Note: On April 1, 2023, the Company performed a 5-for-1 stock split of common shares. The upper limit of the total number of shares of restricted stock to be allotted in each fiscal year is therefore no more than 140,000.

As of the conclusion of the Ordinary General Meeting of Shareholders, the number of Directors (excluding the Directors who are the Audit and Supervisory Committee Members) is six (6), and it is three (3) excluding the Outside Directors.

As for the aggregate amount of remunerations for the Directors who are the Audit and Supervisory Committee Members, it was approved at the 52nd Ordinary General Meeting of Shareholders held on June 24, 2021 to be capped at 200 million yen annually.

As of the conclusion of the Ordinary General Meeting of Shareholders, the number of Directors who are Audit and Supervisory Committee Members is five (5).

(3) Matters concerning Determination on the Details of Remunerations for Individual Directors (excluding the Directors who are the Audit and Supervisory Committee Members)

When reviewing remuneration standards, the Company selects benchmark companies and also refers to remuneration standards that takes into consideration results of surveys conducted by external third-party professional organizations. The Board of Directors then determines the details of the amount of remunerations for the Directors (excluding the Directors who are the Audit and Supervisory Committee Members) after consultation with the Nomination and Remuneration Committee majority of which are independent Outside Directors and chaired by an Outside Director. Since the amounts of remunerations for individual Directors are determined through such procedures, the Board of Directors judges that their details are in line with the Policy.

Frequency of Board of Directors, Audit Committee Meetings and Nomination and Remuneration Committee

- In addition to the Board of Directors meets once a month in principle, it also meets as needed. (The Board of Directors held a total of 12 meetings in FY2023)

- Attendance of individual Directors at meetings of the Board of Directors and other meetings is as follows (FY2023).

| Board of Directors meetings | Audit and Supervisory Committee | Nomination and Remuneration Committee | |

|---|---|---|---|

| Yoshiharu Inaba | 12 of 12 | - | 3 of 3 |

| Kenji Yamaguchi | 12 of 12 | - | 3 of 3 |

| Ryuji Sasuga | 12 of 12 | - | - |

| Michael J. Cicco | 12 of 12 | - | - |

| Naoko Yamazaki | 12 of 12 | - | 3 of 3 |

| Hiroto Uozumi | 12 of 12 | - | 3 of 3 |

| Yoko Takeda | 12 of 12 | - | 3 of 3 |

| Toshiya Okada | 12 of 12 | 13 of 13 | - |

| Hidetoshi Yokoi | 12 of 12 | 13 of 13 | - |

| Mieko Tomita | 12 of 12 | 12 of 13 | 3 of 3 |

| Shigeo Igashima | 12 of 12 | 13 of 13 | - |